Tuesday, 31 October 2017

Friday, 27 October 2017

Trading with Ichimoku Clouds in Indian MCX - Introduction of Ichimoku Cloud System

What is Ichimoku Kinko Hyo?

Ichimoku Kinko Hyo is a multifunctional visual trend following charting system. It mentioned to be the king of the indicators and trading or analyzing with it is a kind of high level art.

What does it's name mean?

Ichimoku means: one glance, Kinko means: equilibrium (or balance), and Hyo means: chart.

The term Ichimoku Kinko Hyo could be translated as: 'One glance equilibrium chart', or 'Chart balance at a glance'.

Who created the Ichimoku Kinko Hyo system?

It was developed by a Japanese economic journalist, name Goichi Hosoda, who aimed to create a kind of „all-in-one” indicator to analyze the charts more deeply but in less time.

Why is the system so special?

With Ichimoku, it is possible to get the whole picture of the market, including trend direction, the main support/resistance levels, and exact entry or exit points. It also helps to define the strength of the signal. It is also important, that Ichimoku can be used successfully for all markets and on all time frames, but – like most indicators - it performs a bit better on the higher ones.

Is it a stand-alone system?

Ichimoku Kinko Hyo can be used in many ways. It can be used as a stand-alone system, or it can be used as a trend and price behaviour analyser and can be combined with any trading systems or strategies. It also can be used as an entry signal generator, or it can be used to filter the signals of another trading system. Furthermore, as trading Ichimoku is a kind of high-level art, and art is quite a subjective thing, every Ichimoku trader trades the Ichimoku a bit differently.

What are the components of the Ichimoku Kinko Hyo system?

Ichimoku Kinko Hyo is constituted by five lines:

1. The Tenkan-Sen (Conversion line) is calculated as (Highest High + Lowest Low)/2 for the past 9 periods.

2. The Kijun-Sen (Standard line) is calculated as (Highest High + Lowest Low)/2 for the past 26 periods.

3. The Chikou Span (Lagging Span) is calculated as current price time-shifted backwards 26 periods.

4. The Senkou Span A (Faster Span A) is calculated as (Tenkan-Sen + Kijun-Sen)/2.

5. The Senkou Span B (Faster Span B) is calculated as (Highest High + Lowest Low)/2.

Ichimoku Kinko Hyo is a multifunctional visual trend following charting system. It mentioned to be the king of the indicators and trading or analyzing with it is a kind of high level art.

What does it's name mean?

Ichimoku means: one glance, Kinko means: equilibrium (or balance), and Hyo means: chart.

The term Ichimoku Kinko Hyo could be translated as: 'One glance equilibrium chart', or 'Chart balance at a glance'.

Who created the Ichimoku Kinko Hyo system?

It was developed by a Japanese economic journalist, name Goichi Hosoda, who aimed to create a kind of „all-in-one” indicator to analyze the charts more deeply but in less time.

Why is the system so special?

With Ichimoku, it is possible to get the whole picture of the market, including trend direction, the main support/resistance levels, and exact entry or exit points. It also helps to define the strength of the signal. It is also important, that Ichimoku can be used successfully for all markets and on all time frames, but – like most indicators - it performs a bit better on the higher ones.

Is it a stand-alone system?

Ichimoku Kinko Hyo can be used in many ways. It can be used as a stand-alone system, or it can be used as a trend and price behaviour analyser and can be combined with any trading systems or strategies. It also can be used as an entry signal generator, or it can be used to filter the signals of another trading system. Furthermore, as trading Ichimoku is a kind of high-level art, and art is quite a subjective thing, every Ichimoku trader trades the Ichimoku a bit differently.

What are the components of the Ichimoku Kinko Hyo system?

Ichimoku Kinko Hyo is constituted by five lines:

1. The Tenkan-Sen (Conversion line) is calculated as (Highest High + Lowest Low)/2 for the past 9 periods.

2. The Kijun-Sen (Standard line) is calculated as (Highest High + Lowest Low)/2 for the past 26 periods.

3. The Chikou Span (Lagging Span) is calculated as current price time-shifted backwards 26 periods.

4. The Senkou Span A (Faster Span A) is calculated as (Tenkan-Sen + Kijun-Sen)/2.

5. The Senkou Span B (Faster Span B) is calculated as (Highest High + Lowest Low)/2.

Tuesday, 3 October 2017

Saturday, 30 September 2017

Introduction and Installation NinjaTrader Algo Trading add on "AlgOto NinjaTrader Bridge"

AlgOto NinjaTrader Bridge Installation :

1. In order to use this Ninja Trader (NT) bridge with AlgOto you need perform some simple steps as explained below , go through below proceedure step by step and you are done !

Download NinjaTrader Bridge (KiteBridge.exe) Click here

2. Open the downloaded "KiteBridge.exe" , once opened you will see by default install path will be selected to "C:\Users\username\Documents\NinjaTrader 7\bin\Custom" which should not be changed !, but make sure you have such a folder and Ninja Trader 7 free version installed , Click on Install button

3. Now open NinjaTrader or if already opened navigate to it , and go to Tools > Edit NinjaScript > Strategy..

4. Select any of the available Strategy and click ok button

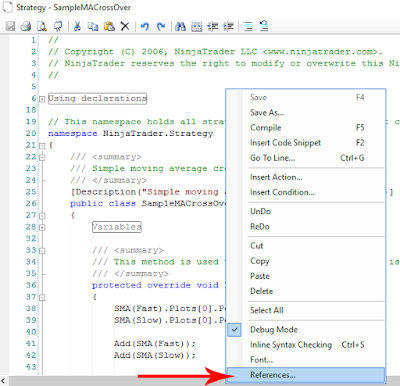

5. Right click over any blank area on NinjaStrategy window and select References..

6. Click on Add button and navigate to C:\Users\YourUserName\Documents\NinjaTrader 7\bin\Custom and select KiteBridge.dll and click open, then click OK

Place below line of code to your strategy exactly below the

Place below line of code to your strategy exactly below

1. In order to use this Ninja Trader (NT) bridge with AlgOto you need perform some simple steps as explained below , go through below proceedure step by step and you are done !

Download NinjaTrader Bridge (KiteBridge.exe) Click here

2. Open the downloaded "KiteBridge.exe" , once opened you will see by default install path will be selected to "C:\Users\username\Documents\NinjaTrader 7\bin\Custom" which should not be changed !, but make sure you have such a folder and Ninja Trader 7 free version installed , Click on Install button

3. Now open NinjaTrader or if already opened navigate to it , and go to Tools > Edit NinjaScript > Strategy..

4. Select any of the available Strategy and click ok button

5. Right click over any blank area on NinjaStrategy window and select References..

6. Click on Add button and navigate to C:\Users\YourUserName\Documents\NinjaTrader 7\bin\Custom and select KiteBridge.dll and click open, then click OK

7. After completing above step you are done with the KiteBridge referencing , now its time to code to pass orders generated by Ninja to AlgOto !

Place below line of code to your strategy exactly below

8. Now to Place Orders use below codes inside your strategy conditions :

Example Buy Order:

Example Sell Order :

Introduction of Algo Trading with NinjaTrader on Indian MCX

1. Trading account with India’s leading discount broker Zerodha.

2. Need to register for Zerodha’s Kite API which will cost you Rs 2,000 Per Month.

To know more about Zerodha Kite API, Click here

To enable Zerodha Kite API, Click here

3. Download and install free NinjaTrader7.

Click here

4. Download and Install our AlgOto application to interact between Zerodha Kite API and NinjaTrader.

Click here

5. Download and Install KiteBridge to interact between AlgOto and NinjaTrader

Click here

6. Develop your trading strategy in NinjaTrader and relax. No emotion will ride you to wrong trades anymore!!

2. Need to register for Zerodha’s Kite API which will cost you Rs 2,000 Per Month.

To know more about Zerodha Kite API, Click here

To enable Zerodha Kite API, Click here

3. Download and install free NinjaTrader7.

Click here

4. Download and Install our AlgOto application to interact between Zerodha Kite API and NinjaTrader.

Click here

5. Download and Install KiteBridge to interact between AlgOto and NinjaTrader

Click here

6. Develop your trading strategy in NinjaTrader and relax. No emotion will ride you to wrong trades anymore!!

Algo Trading Testing with NinjaTrader on Indian MCX Market

What is AlgOto ?

AlgOto is a trading platform developed on top of Zerodha Kite API , which lets Zerodha clients to use world's leading charting applications with Indian market data without paying or subscribing to additional market data service provider.

How AlgOto works ?

It works as a trading platform with functions allowed by Zerodha Kite API and it feeds market data to charting applications such as NinjaTrader. AlgOto by default comes with NinjaTrader bridge which lets you place orders from Ninja Strategies to Kite API.

What are the features of AlgOto ?

AlgOto is a trading platform developed on top of Zerodha Kite API , which lets Zerodha clients to use world's leading charting applications with Indian market data without paying or subscribing to additional market data service provider.

How AlgOto works ?

It works as a trading platform with functions allowed by Zerodha Kite API and it feeds market data to charting applications such as NinjaTrader. AlgOto by default comes with NinjaTrader bridge which lets you place orders from Ninja Strategies to Kite API.

What are the features of AlgOto ?

- Built-in NinjaTrader bridge

- BO, CO orders with limit price

- BO, CO orders at any market !!

- Bucket Order

- Auto Pre-Open Order firing

Friday, 15 September 2017

Subscribe to:

Posts (Atom)