Thursday, 7 November 2013

Wednesday, 6 November 2013

Crude oil climbs to session high after bullish supply data

Crude oil futures extended gains on Wednesday, after a government report showed that U.S. oil supplies rose less-than-expected last week.

On the New York Mercantile Exchange, light sweet crude futures for delivery in December traded at USD94.55 a barrel during U.S. morning trade, up 1.25%.

Nymex oil prices traded at USD94.38 a barrel prior to the release of the supply data.

New York-traded oil futures traded in a range between USD93.36 a barrel, the daily low and a session high of USD94.65 a barrel.

The December contract fell to USD93.07 a barrel on Tuesday, the lowest since June 24, before settling at USD93.37 a barrel, down 1.32%.

Oil futures were likely to find support at USD93.07 a barrel, Tuesday’s low and resistance at USD96.64 a barrel, the high from November 1.

The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories rose by 1.57 million barrels in the week ended November 1, compared to expectations for an increase of 1.63 million barrels.

Total U.S. crude oil inventories stood at 385.4 million barrels.

The report also showed that total motor gasoline inventories declined by 3.8 million barrels, compared to expectations for a drop of 338,000 barrels.

U.S. crude prices have been on a downward trend in recent weeks amid concerns the recent U.S. government shutdown created a drag on economic growth and eroded demand in the world’s largest oil consumer.

Market players now looked ahead to the release of key U.S. economic data later in the week to help assess the timing for a reduction in the Federal Reserve’s bond-purchasing program.

The U.S. is set to release preliminary data on third quarter economic growth on Thursday, while October’s highly-anticipated nonfarm payrolls report is scheduled for Friday.

Elsewhere, on the ICE Futures Exchange, Brent oil futures for December delivery rose 0.55% to trade at USD105.90 a barrel, with the spread between the Brent and crude contracts standing at USD11.35 a barrel.. By Investing.com

Nymex oil prices traded at USD94.38 a barrel prior to the release of the supply data.

New York-traded oil futures traded in a range between USD93.36 a barrel, the daily low and a session high of USD94.65 a barrel.

The December contract fell to USD93.07 a barrel on Tuesday, the lowest since June 24, before settling at USD93.37 a barrel, down 1.32%.

Oil futures were likely to find support at USD93.07 a barrel, Tuesday’s low and resistance at USD96.64 a barrel, the high from November 1.

The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories rose by 1.57 million barrels in the week ended November 1, compared to expectations for an increase of 1.63 million barrels.

Total U.S. crude oil inventories stood at 385.4 million barrels.

The report also showed that total motor gasoline inventories declined by 3.8 million barrels, compared to expectations for a drop of 338,000 barrels.

U.S. crude prices have been on a downward trend in recent weeks amid concerns the recent U.S. government shutdown created a drag on economic growth and eroded demand in the world’s largest oil consumer.

Market players now looked ahead to the release of key U.S. economic data later in the week to help assess the timing for a reduction in the Federal Reserve’s bond-purchasing program.

The U.S. is set to release preliminary data on third quarter economic growth on Thursday, while October’s highly-anticipated nonfarm payrolls report is scheduled for Friday.

Elsewhere, on the ICE Futures Exchange, Brent oil futures for December delivery rose 0.55% to trade at USD105.90 a barrel, with the spread between the Brent and crude contracts standing at USD11.35 a barrel.. By Investing.com

Live Trade Net Result on 06.11.13

TOTAL MTM - Rs 1,26,050 on 06.10.10 LEDGER BALANCE.

Live Trade Net Result on 06.11.13

TOTAL NO OF TRADES - 7

POSITIVE -7

NEGATIVE - 0

TRADE 1 -COPPER - LONG - NET PROFIT - Rs 3500

TRADE 2 - CRUDE OIL - LONG - NET PROFIT - Rs 5000

TRADE 3 - ALUMINI - LONG - NET PROFIT - Rs 600

TOTAL MTM - Rs 1,26,050 + Rs 19,900/-

TOTAL MTM - Rs 1,45,950 on 07.10.10 LEDGER BALANCE.

Live Trade Net Result on 06.11.13

TOTAL NO OF TRADES - 7

POSITIVE -7

NEGATIVE - 0

TRADE 1 -COPPER - LONG - NET PROFIT - Rs 3500

TRADE 2 - CRUDE OIL - LONG - NET PROFIT - Rs 5000

TRADE 3 - ALUMINI - LONG - NET PROFIT - Rs 600

TRADE 4 - ZINCMINI - LONG - NET PROFIT - Rs 800

TRADE 5 - SILVERM - LONG - NET PROFIT - Rs 3200

TRADE 6 - LEADMINI - LONG - NET PROFIT - Rs 600

TRADE 7 - CRUDE OIL - LONG - NET PROFIT - Rs 6200

So Net Profit Rs 19,900/- ON 06.11.13.

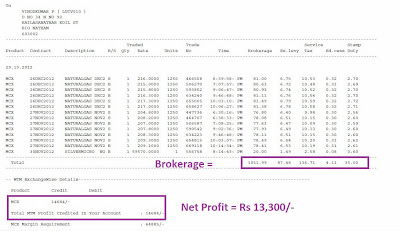

Ref., Last year Live Contract Note Amount Profit Amount matched for today trade..It's possible on one day trade by a highly accurate technical support..

TRADE 7 - CRUDE OIL - LONG - NET PROFIT - Rs 6200

So Net Profit Rs 19,900/- ON 06.11.13.

Ref., Last year Live Contract Note Amount Profit Amount matched for today trade..It's possible on one day trade by a highly accurate technical support..

TOTAL MTM - Rs 1,26,050 + Rs 19,900/-

TOTAL MTM - Rs 1,45,950 on 07.10.10 LEDGER BALANCE.

Live Trade Net Result on 05.11.13

TOTAL MTM - Rs 1,23,550/- on 05.10.10 LEDGER BALANCE.

Live Trade Net Result on 05.11.13

TOTAL NO OF TRADES - 1

POSITIVE - 1

NEGATIVE - 0

TRADE 1 - CRUDE OIL - LONG - NET PROFIT - Rs 2500

TOTAL MTM - Rs 1,23,550 + Rs 2,500

TOTAL MTM - Rs 1,26,050 on 06.10.10 LEDGER BALANCE.

Live Trade Net Result on 05.11.13

TOTAL NO OF TRADES - 1

POSITIVE - 1

NEGATIVE - 0

TRADE 1 - CRUDE OIL - LONG - NET PROFIT - Rs 2500

TOTAL MTM - Rs 1,23,550 + Rs 2,500

TOTAL MTM - Rs 1,26,050 on 06.10.10 LEDGER BALANCE.

Live Trade Dairy by Live Signal and Live Trade on ZincM on 06.11.13 ..Part 4

Zinc M Mcx Nov: buy at present levels(CMP 119.05) And on dips to 118.80, TGT 120.40, SL below 118 11/6/2013 : 12:59:47 PM

Buy Zinc M @ 118.75

Sell Zinc M @ 119.75

Net Profit - Rs 800/-

Book Profits CMP 119.65((Zinc M Mcx Nov: buy at present levels(CMP 119.05) And on dips to 118.80, TGT 120.40, SL below 118 Time 12:59:47 PM)) 11/6/2013 : 2:42:11 PM

Subscribe to:

Comments (Atom)